The 4.2% Illusion: Decoding the Real Story of U.S. Hiring In Finance

Beneath the calm surface of a steady unemployment rate, a sea change is underway in finance and wealth management. Here's what the data really tells us.

It’s tempting, isn’t it? To glance at the dashboard of the U.S. economy in mid-2025, see the steady 4.2% unemployment rate, a green light shining for three months straight. As we see this, we assume the road ahead is smooth. After the dizzying rollercoaster of the pandemic, the frantic hiring surges, and the whispers of recession, stability feels like a destination. But as any seasoned analyst knows, the most important stories often lie beneath the headlines. The dashboard light might be green, but what are the other gauges telling us? What’s that quiet hum beneath happening in finance and wealth management?

Driving through the complex landscape of U.S. finance hiring requires more than a glance. You need to read all the dials. Our analysis reveals that beneath this surface stability, the employment trends in wealth management jobs, banking, insurance, and the broader financial services recruitment market signal significant undercurrents, a tectonic reshaping.

We see a fascinating divergence: a national market pumping its brakes, while certain corners of finance driven by the twin engines of RIA M&A and AI in Finance show surprising bursts of acceleration. It’s a paradox: stability coexisting with radical change, opportunity alongside profound frustration.

-Capithos

This post dives into these "outlier" signals. We'll peel back the layers of the BLS Reports, look at the whispers in the JOLTS data finance, and examine the lessons from past market "tipping points" – those moments when everything changed. We'll explore the M&A wave creating Goliaths from Davids and the AI revolution demanding a new breed of "Financial Polymath." And, crucially, we'll investigate why, in an age of unprecedented connection, finding the right financial careers or the right FinTech talent feels harder, more expensive, and more bewildering than ever – a Connection Conundrum born in the noisy digital town square. Finally, we'll look towards a potential disruption: a new model for connecting verified talent with opportunity.

Strap in. The road ahead isn't as smooth as it looks.

I. The Market's Pulse: Is It Calm, or Just Quiet?

A. The National Picture: A Steady Beat, But Fading Tempo

The Bureau of Labor Statistics (BLS) gives us the headline: +177,000 jobs in April. It’s not a boom, but it’s not a bust. It’s the sound of an economy that hasn't stalled. But listen closely. That number is down from previous averages, and prior months saw downward revisions totaling 58,000 jobs. It's the difference between a brisk walk and a leisurely stroll, perhaps with a slight limp. The unemployment rate holds steady at 4.2%, a level that feels ‘normal-ish’, but the Labor Force Participation Rate remains stubbornly below pre-pandemic levels. There are still 'missing players' on the field.

This cautious stability is happening under the shadow of uncertainty. Will the newly implemented tariffs bite? Will interest rates finally pivot? These questions hang in the air, making businesses hesitant to make big bets.

B. The Finance Anomaly: Why Is Wall Street Humming a Different Tune?

Here’s where it gets interesting. While the nation whispers caution, Financial Activities added 14,000 jobs in April. And the JOLTS finance data for March? It’s a genuine puzzle. While national job openings fell by 325,000, Finance & Insurance openings jumped by 25,000. People are also quitting finance jobs more readily (+25,000 in March).

It’s like the whole country decided to window shop less, except for the luxury boutiques on Wall Street, where they're not only looking but also confidently switching stores.

Source: U.S. Bureau of Labor Statistics (JOLTS)

This Finance Anomaly suggests the industry isn't just reacting to the macro-economy; it's being reshaped by internalforces. The low 2.3% unemployment rate in the sector isn't just a number; it means the right people, those with coveted skills like CFA, CFP, FRM designations, or AI expertise, are in high demand. It’s a niche war for talent amidst a broader ceasefire.

C. Sector Spotlights: Not All Boats Rise (or Fall) Together

Even within finance, the picture isn't uniform. The Insurance sector often acts as a ballast, showing greater stability. Reports from Jacobson Group indicated ongoing stability and plans for maintaining or increasing headcount, especially in tech, underwriting, and claims. It's less sensitive to market whims and more driven by demographics and risk trends.

Banking employment, however, feels the winds of change more directly. Technology isn't just an add-on; it's reshaping core functions. While some roles face displacement, others are emerging at the intersection of tech and client service. Wealth management jobs, as we'll see, are caught right in the centre of both the M&A and AI storms. It's not one market; it's many, each with its own microclimate.

II. Echoes from the Edge: History's Lessons on Hiring Tipping Points

To understand today's caution and tomorrow's possibilities, we must look back. The financial sector has a memory, etched with the scars of past crises.

A. The GFC Scar: When the Foundation Cracked

The 2008 Global Financial Crisis wasn't just another recession; it was an existential event for finance. It originated within the industry, and the fallout was seismic. It wasn't just about layoffs; it was about a fundamental loss of trust and a forced rewiring of the entire system. Think of the feel of that time: hiring freezes weren't suggestions; they were mandates. Lehman Brothers vanishing overnight. The desperate search for risk management careers a field that suddenly became the most important in the building.

The GFC taught us a crucial lesson: the financial sector's vulnerability is most acute when the crisis hits its core functions. Its memory means that even a hint of systemic risk today triggers a much faster, more cautious response.

B. The COVID Pivot: Resilience Under Pressure

Contrast that with 2020. COVID was an external shock, unprecedented in speed and scale. Yet, finance pivoted. It proved surprisingly adaptable, leveraging technology to shift to remote work almost seamlessly. It showed resilience. Why? Because its core functions weren't broken, and its services remained essential.

COVID was the "Blink" moment that accelerated the digital transformation. It proved that finance careerscould exist outside a skyscraper, and it turbocharged the demand for the very tech skills that are now central to AI in Finance.

C. The Key Insight: Context is Everything

History shows us that finance isn't a monolith. It reacts differently depending on the threat. Internal shocks are devastating. External operational shocks can be navigated. And policy uncertainty (Tariffs, Brexit)? That leads to the quiet hum, the cautious dance we see today, a market waiting for a clear signal.

III. The Great Reshuffle: Navigating Mergers, Machines, and the Modern Hiring Maze

This brings us to the heart of the matter, the powerful forces of RIA M&A and AI in Finance, and how they collide with the messy reality of the finance job market.

A. The Consolidation Wave: When RIAs Become Goliaths

The RIA consolidation trend is relentless. A record 75 deals in Q1 2025 alone shows a market coalescing at an astonishing rate.

This isn't just a financial story; it’s a cultural one. What happens when a "Main Street" RIA meets a "Wall Street" PE firm? You get a "culture clash." This wave creates demand for M&A integration specialists, but it also creates displacement, pushing experienced advisors back into a baffling market.

The New Hiring Blueprint: More Than Just New Titles

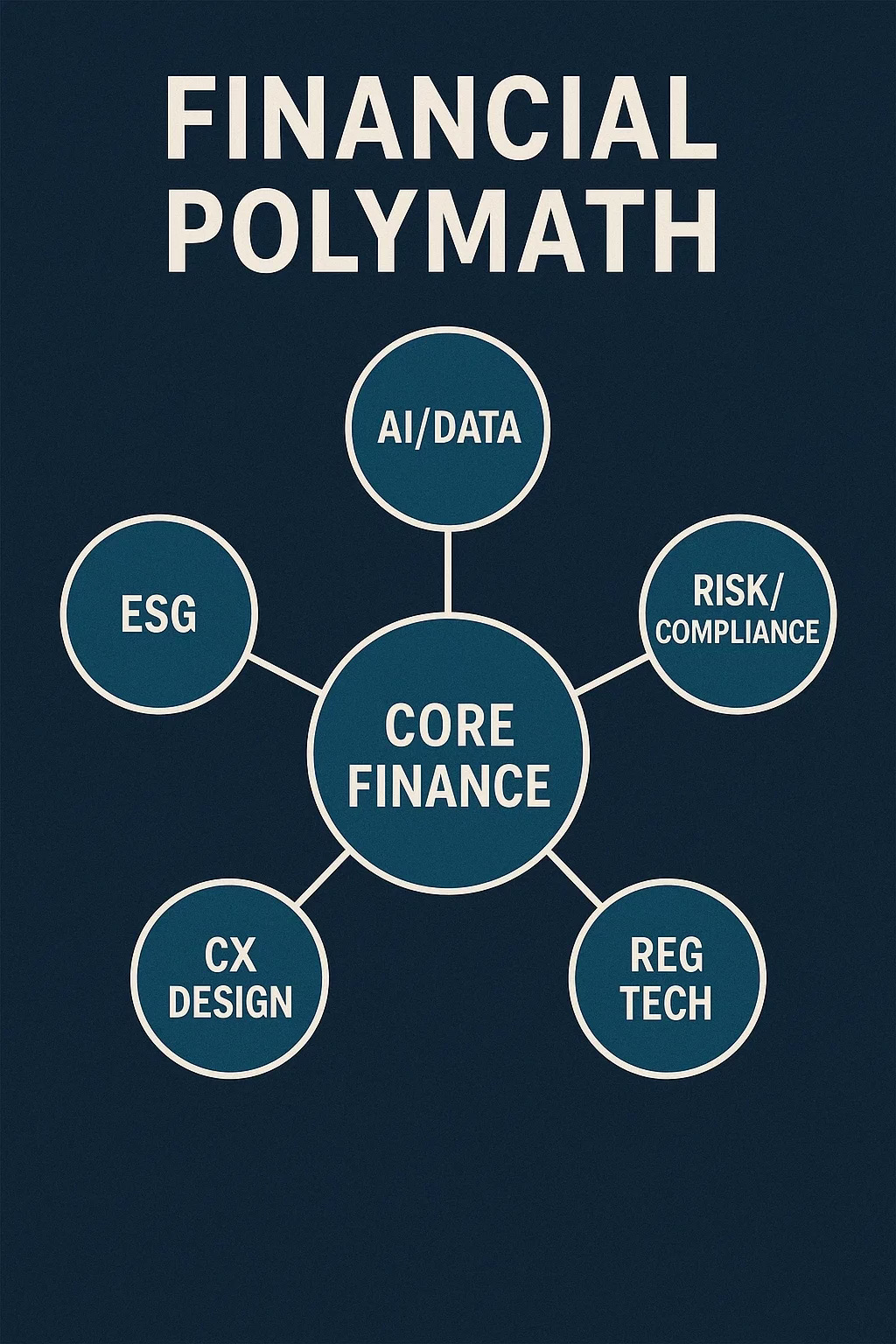

Simultaneously, AI in Finance is becoming the "super-intern," creating a profound financial services skill shift. Firms aren't just hiring more; they're hiring different. They seek the Financial Polymath.

What’s in demand:

AI & Data Brigade: Data Scientists, Quants, AI/ML Engineers, AI Governance Specialists.

Risk & Resilience Sentinels: Cybersecurity Analysts, RegTech Innovators, ESG Analysts.

Evolved Client & Ops Gurus: Tech-Fluent Advisors, CX Designers, M&A Integration Specialists.

Walk into the gleaming lobby of a major financial institution today, and you might feel a subtle shift, an undercurrent of change. The conversations, the roles, the very pulse of the place – it's different. It's not just about analysts hunched over spreadsheets anymore. We're seeing the emergence of a new breed, a "New Hiring Blueprint" born from necessity.

Think of it as the financial world's response to an evolutionary pressure. You have the AI & Data Brigade, the digital cartographers and architects – the Data Scientists, the Quants, the AI/ML Engineers. But alongside them, crucially, walk the AI Governance Specialists, the ethicists and guardians ensuring these powerful new tools don't lead us astray.

Then there are the Risk & Resilience Sentinels. In an age where a single keystroke can ripple across continents, Cybersecurity Analysts aren't just IT support; they're the digital-era G-men. They're joined by RegTech Innovators, streamlining compliance in an increasingly complex world, and the ESG Analysts, asking the vital question: Is this growth sustainable and responsible?

And finally, the Evolved Client & Ops Gurus. These aren't your grandfather's bankers. Tech-Fluent Advisors speak the language of both finance and code. CX Designers obsess over the experience of money, not just its movement. And M&A Integration Specialists act as the crucial connective tissue in a world of constant consolidation. These aren't just jobs; they're archetypes for a new financial age. But this new age brings its own peculiar set of challenges.

The AI Paradox: The Pilot Who Never Takes Off

Consider the classic path to mastery: apprenticeship. The aspiring pilot learns by sitting beside the seasoned captain, first observing, then handling the controls during calm stretches, eventually mastering the tricky takeoffs and landings. But what happens when the plane increasingly flies itself?

This is the AI Paradox haunting finance today. We herald AI's power to automate, to optimize, to see patterns humans miss. It handles the 'takeoffs,' the routine tasks, with effortless grace. But in doing so, how does the next generation learn? How do you become a seasoned pilot if the most critical parts of the journey are handled by an algorithm? This isn't a theoretical question. It's the lived reality behind that baffling, frustrating job post: "Entry-level position, 5 years experience required." It’s a paradox born of progress, a chasm that the old ways of learning and hiring simply cannot bridge.

C. The Digital Deluge: Counting the Jobs, Missing the Signal

Now, look at the numbers. On the surface, they tell a story of incredible opportunity. The Bureau of Labor Statistics' JOLTS report in March showed over 360,000 openings in "Finance & Insurance." A hiring boom, surely? A sign of a vibrant, expanding industry hungry for talent.

But what if the numbers are lying? Or, more precisely, what if they're telling us something, but not what we thinkthey're telling us? We're not witnessing a gentle, life-giving rain; we're caught in a Digital Deluge. It's a confusing flood. Many of these postings, it turns out, are "ghost jobs" – positions kept open indefinitely, perhaps for compliance, perhaps out of inertia, perhaps never intended to be filled at all. Others are duplicates, echoes bouncing around the vast chambers of the internet.

The sheer number obscures the reality. We are drowning in data, but starving for information. It's a high-volume, low-signal environment. And trying to navigate this flood, for both companies and job seekers, comes at a steep, often hidden, cost.

D. The High Cost of Misfires: Why Finding Talent Breaks the Bank

Let's talk about fishing. Imagine you want to catch a specific, rare fish. You could, in theory, drain the entire lake – an incredibly expensive and inefficient process. Or, you could understand the fish's habits, its environment, and use the right lure. For years, financial hiring has resembled the former.

It isn't cheap. The average cost-per-hire (CPH) in finance hovers around $4,300. And that’s before you factor in recruiter fees, which can swallow a hefty 15-40% chunk of the first year's salary. Why this staggering expense? It’s the price tag on inefficiency. Firms spend vast sums casting wide nets on generalist finance job boards. They're trying to drain the lake. They're trawling through thousands of applications, many irrelevant, hoping to snag the right candidate. It’s an expensive, exhausting, and surprisingly ineffective way to fish, leading to what we might call the Connection Conundrum.

E. The Connection Conundrum: Drowning in the Job Board Swamp

Visit the online forums, like the popular r/FinancialCareers subreddit on Reddit. You'll find a particular kind of modern despair. It's the sound of skilled, ambitious people shouting into a void. This is the Connection Conundrum – the lived, often soul-crushing experience of trying to find your place in this new financial world. It’s a swamp, thick with obstacles:

The Recruiter Roulette: Imagine explaining the nuanced differences between a CFA, a CFP, an FRM, and an SIE to someone who barely understands the industry. It’s a game of chance where vital signals – hard-won credentials – are lost in translation.

Ghost Job Haunting: It's the digital equivalent of Sisyphus, pushing your application (your hopes) up a hill, only to have it disappear. Applying for roles that seem perfect, yet feel oddly unreal, never eliciting a response.

The ATS Black Hole: Your meticulously crafted resume, full of skills and experience, vanishes into the maw of an Applicant Tracking System, likely rejected by an algorithm that didn’t understand its context or value.

The Spam & Scams: And through it all, you must wade through a murky tide of bots, phishing attempts, and irrelevant offers.

Is it any wonder this environment breeds cynicism? It makes qualified, capable professionals feel utterly invisible, lost in a system that seems designed to ignore them.

F. The Disconnect Decoded: Two Ships Passing in the Night

So, why this gaping chasm between those who need talent and those who possess it? It's not one single cause, but a confluence of factors – a perfect storm brewing at the intersection of technology, tradition, and transformation.

Firms need new skills, the kind we saw in the "New Hiring Blueprint." They need people who can navigate the digital world, understand AI, and manage complex risks.

Seekers struggle to signal these new skills. Traditional resumes and platforms often fail to capture the blend of finance and tech, the polymath nature now required.

Platforms amplify noise. The digital deluge, the ghost jobs – they drown out the meaningful signals.

Recruiters often lack context. Caught in the "Recruiter Roulette," they struggle to differentiate and understand the specialized needs and qualifications.

The system, built for a bygone era, simply can't keep up. It’s like two massive ships, one representing employers and the other talent, passing silently in the dense fog, each unaware of the other's true position. The system doesn't just need a bigger foghorn; it screams for a new kind of lighthouse.

V. Strategic Implications: Navigating Towards 2030

How do we navigate these treacherous waters? How do we find our way to 2030 without running aground? It requires a shift in perspective, a new map, for both sides of the hiring equation.

A. The Employer's Playbook:

Look Beyond Keywords: The old game of scanning resumes for buzzwords is over. The focus must shift to verified skills and understanding the real needs of the "New Hiring Blueprint." It’s about potential, not just pedigree.

Rethink Your Tools: Are the giant, generalist job boards really serving you? It's time to explore niche and even decentralized networks where signals are stronger and noise is weaker.

Invest in Culture: In an M&A-driven world where teams constantly merge and reform, a strong, adaptable culture isn't a "nice-to-have"; it's your most potent differentiator.

B. The Job Seeker's Compass:

Verify, Don't Just Post: Don't just list your credentials; make them verifiable. Highlight those CFA, CFP, FRM, SIEs in ways that cut through the noise.

Embrace Polymath Status: The future belongs to those who can blend finance with tech, analysis with communication, risk with innovation. Don't hide your diverse skills; showcase them.

Curate Your Network: In this swamp, a vast, shallow network is useless. Focus on building quality connections over quantity.

The finance hiring landscape, it turns out, is far more complex and fascinating than it appears. Success, for both firms and individuals, demands that we look past the illusion of simplicity. It requires us to understand the hidden patterns, the paradoxes, the undercurrents. And, most importantly, it demands that we embrace smarter, more intentional ways of connecting.

IV. The Capithos Vision: A Decentralized Future for Financial Intelligence & Talent

What if the answer isn't a bigger, louder town square? What if, instead, we need a network of smaller, interconnected villages? What if the solution lies not in centralizing information, but in decentralizing it, making it smarter, more secure, and built on a foundation of trust?

This isn't just a hypothetical question. This is the Tipping Point we see coming. It’s the future we at Capithos are building. What if the solution to the "Connection Conundrum," the "Digital Deluge," and the "High Cost of Misfires" is a decentralized financial intelligence P2P network? One built on verified intelligence and peer-to-peer trust, where credentials aren't just keywords but proven facts.

We believe this is the way to cut through the noise. Our ecosystem, already embracing over 600,000 professionalsholding verified credentials like CFA, CFP, FRM, SIEs, and more, focuses on what matters. It's a shift from the megaphone to the trusted conversation, from the swamp to the lighthouse. Decentralization isn't just a technology; it's a new philosophy for connection.

Through Capithos we’re building just this. Subscribe or request free beta access to our data of over 46K+ Investment Firms & 600K+ Financial Professionals for free. All we ask is for feedback from the financial community.

request at contact@theriareport.com