Markets Making New Highs. Existing Firms Declined.

-2.77% as a matter of fact from this time last month. Just a month ago, in our article, The Quiet Revolution, we laid out the slow, seismic shift of capital and talent away from the traditional bedrock of New York and California and toward a new constellation of “Alpha Markets.” We presented eighteen months of data, a compelling narrative of change.

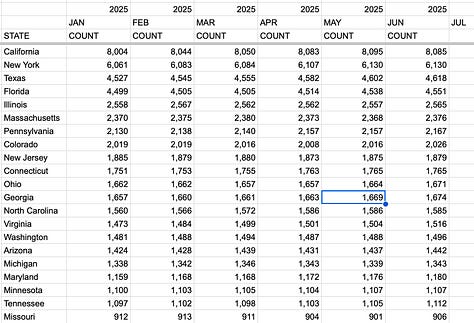

That was May. Now, the calendar has flipped to July. The first half of 2025 is in the books, and we have another frame of film to analyze. And if you listen closely, the ticking clock we spoke of has become a steady, more insistent drumbeat. The trends aren’t just continuing; in the brief 30 days of June, they began to accelerate.

Let’s dive into the numbers for June.

The analysis in this article is powered by Capithos. Financial intelligence on 64,286 registered RIA & SEC firms, 400,000 financial professionals, and 75+ finance and banking job boards. To get direct access to firm owners, proprietary intel, and the analytics, subscribe.

The Thirty-Day Snapshot: When an Anomaly Becomes a Pattern

Let’s look at the raw film. In the month of June, as the second quarter drew to a close, the numbers continued their migration.

Consider the old titans. California, which we noted had been playing catch-up, saw its roster of registered firms slip once more, from 8,095 in May to 8,085 in June. A loss of ten firms. In the grand scheme of eight thousand, it’s a rounding error. But it’s the persistence of the error that tells the story. It's a slow leak, the kind you ignore until you find yourself standing in an inch of water. New York? Perfectly flat. A giant holding its breath, with its count static at 6,130 firms. Stagnation, in a growth industry, is its own kind of retreat.

Now, turn your gaze back to the "emergence zones." Texas didn't just grow; it added another 16 firms, moving from 4,602 to 4,618. Florida tacked on 13 more. But the truly fascinating signals came from the next tier. South Carolina, a market we highlighted in our "Alpha" list, jumped by 15 firms. For a state its size, that’s a significant monthly influx. Colorado added 10. Utah, 9. Tennessee, 7.

These aren't lottery wins. They are calculated decisions, made one by one, by hundreds of founders and executives, all arriving at a similar conclusion. The map we spoke of in May isn't just being redrawn; it’s being etched in stone, month by month.

And the "why" behind these numbers became clearer than ever in June, as the M&A market, the ultimate arbiter of where the smart money is flowing, roared to life. This wasn’t just about buying scale anymore. It was a land grab. Look at Mercer Advisors, which continued its voracious appetite for expansion by snapping up a thriving practice in Dallas, Texas. The press releases all talk about synergy and client service, but the subtext is written in boldface: We need a bigger footprint where the growth is.

LOWLIGHT: The California Conundrum

No state serves as a more potent symbol of this shift than California. In October 2023, it was the undisputed titan with 8,167 registered firms. Fast forward to June 2025, and that number has eroded to 8,085. While it clawed back some ground in early 2025, the long-term trend is one of leakage, punctuated by a net loss of 10 firms just last month.

This isn't a collapse, not yet. But it’s a leak in a ship that once seemed unsinkable, driven by a trifecta of pressures:

Cost & Taxation: The state's notoriously high cost of living and burdensome tax structure create a powerful financial undertow. For an advisory firm, where talent and capital are mobile, the difference between California’s tax regime and that of a no-income-tax state like Texas or Florida is no longer a rounding error it's a core strategic consideration.

Regulatory Burden: California's complex and ever-expanding regulatory maze acts as a "compliance tax" on new and existing businesses. The time, effort, and legal fees required to navigate this environment deter new entrants and push existing firms to seek simpler, more predictable landscapes.

Market Saturation: Ironically, California's past success is a present challenge. It remains the most crowded market in the nation. This hyper-competition for clients and talent makes organic growth a street fight. For a firm looking to expand, entering a less saturated "Alpha Market" offers a clearer and more profitable path to growth than battling in the red ocean of the Golden State.

The Unseen Currents: What’s Really Driving the Exodus?

So, what happened? It wasn’t one thing. It was a confluence of seemingly unrelated currents that, together, created a perfect storm of change – an "invisible hand," if you will, redrawing our professional landscape.

The Tether Snapped: Remote work fundamentally severed the centuries-old link between where elite talent lived and where elite companies were headquartered.

The Taxman Cometh (Differentially): State tax differentials became acutely magnified, creating a powerful financial undertow pulling firms and individuals toward lower-tax states.

The Boomer Compass: As Baby Boomers entered retirement, their wealth, and often their advisors, began to follow them to lower-cost, higher-amenity regions.

The Tech Equalizer: Technology democratized access to clients and talent. An advisor in Boise can now offer an experience indistinguishable from an advisor in a Boston skyscraper.

This isn't just theory. Look at the M&A data. In 2020, firm data showed roughly 62% of RIA acquisitions involved firms in those top 10 traditional wealth cities. By the first quarter of 2025? That number had plummeted to 41%. The gravitational pull of the old centers is weakening.

A New Quarter, A New Reality

As we enter the third quarter of 2025, the narrative we began charting has only gained resolution. The quiet revolution is getting louder. The month of June wasn't an outlier; it was a confirmation, providing another data point on a line that is pointing distinctly southeast.

The deals announced, like the Beacon Pointe and Mercer acquisitions, underscore the strategic urgency. Acquirers are no longer just buying books of business; they are buying zip codes. They are buying access to the demographic and economic currents that will shape the next decade of wealth creation in America.

The question for every RIA owner and advisor remains the same, but it carries a new weight with each passing month. The data is no longer subtle. The evidence is no longer anecdotal. The only remaining question is one of action. Are you positioned for where the wealth was, or are you moving to where it is going? June was another reminder that the tide waits for no one.

Personal Note:

With the close of June, I want to thank the subscribers and the early partners joining our financial intelligence project, Capithos offline.

We also have a project that we call the ‘brain’ that’s being worked on.

What does the 'brain' do you might ask?

We believe it should handle the work that drains firms energy so they can focus on what matters. It's a system that delivers instant intelligence from complex filings, helps scale personal client communications effortlessly, and acts as a silent guardian for all compliance. Essentially, it can take all the roles in marketing, compliance, asset management, risk, and operations that make a firm go-round, but without the headcount.

We're building the central nervous system for the modern advisory firm, and we can't wait to show you more. Stay tuned.