The End of Search.

A deep dive into the next generation of Financial Advisor SEO, lead generation tactics, and the client acquisition strategies built for the age of AI.

In the 1890s, the world's great cities faced a crisis that threatened to make them uninhabitable. It wasn't sanitation or housing, but something far more mundane: horse manure. The world ran on horsepower, and in cities like New York and London, over 100,000 horses produced millions of pounds of manure every single day. Urban planners, in a panic, predicted that by the 1930s, the streets of Manhattan would be buried under nine feet of it. The existing system had reached its absolute limit. Then, something happened that no one predicted. The automobile appeared, and in less than twenty years, the crisis didn't just vanish the entire system that created it was obliterated.

Today, the world of advisor marketing is facing its own horse manure crisis. For the modern financial advisor, the established system, relying on traditional SEO, buying expensive directory listings, and chasing low-quality financial leads, has peaked long ago. It’s a frustrating, costly, and unsustainable model. But now, the equivalent of the automobile has arrived. The advent of sophisticated AI and immense data-gathering capabilities is not just an improvement on the old system; it's a completely new one that will make the old ways obsolete.

Part 1: The Houston Contrarian and the End of the Old World

To understand this shift, we have to go back to a moment of crisis where new marketing shone through. The year is 2016. The global oil industry, the lifeblood of cities like Houston, is in a state of freefall. After years of riding high with crude oil prices well over $100 a barrel, the market has cratered. A barrel of West Texas Intermediate has plummeted to under $30, a level that makes entire swaths of the industry unprofitable.

The response from the titans of the industry XOM 0.00%↑ , COP 0.00%↑ , CVX 0.00%↑ was swift and brutal. Layoffs, once unthinkable for highly-paid, senior employees, become a daily headline. These are not just entry-level cuts; they are deep, striking engineers, project managers, and executives with decades of experience and wealth tied up in complex corporate compensation structures. A mood of fear and uncertainty grips the city. For most financial advisors, this is a time to retreat, to protect existing assets, and to wait for the storm to pass.

But James Bogart, founder of the RIA Bogart Wealth, saw something different. He didn't see a crisis; he saw a unique, once-in-a-generation dislocation. He recognized that thousands of people were facing the exact same complex, life-altering financial problem all at once. Their core challenge wasn't a lack of assets; it was a sudden lack of clarity. They were walking out of their offices with a 401(k), a pension, stock options (both vested and unvested), and a severance package, and they had to figure out how to make it last a lifetime.

Listen to the episode Kitces -

This was the genesis of Bogart's strategy. He realized the traditional marketing playbook was useless here. These anxious executives weren't responding to generic ads about "retirement planning." They had a very specific pain point. So, Bogart chose to become the specialist who could solve that exact pain.

His strategy was pure, targeted education. He began running online webinars with titles that spoke directly to his audience's anxiety, such as "Everything You Need to Know About Your ExxonMobil Retirement Benefits."

Think about the power of this approach in a moment of fear:

It bypassed the sales pitch: In a time of mistrust and uncertainty, he wasn't asking for their money. He was offering clarity, for free. He was building trust by demonstrating expertise on the complex nuances of their specific company benefits.

It created an immediate filter: Anyone who signed up for a webinar about Chevron's pension plan was, by definition, a highly qualified prospect for his firm. He wasn't wasting time or money on anyone else.

It was scalable: Instead of dozens of one-on-one meetings, he could build trust with 20, 40, or 100 people at once. The result was an engine for growth that thrived precisely because the times were bleak. While other firms were contracting, Bogart Wealth was attracting 20 to 40 new, high-net-worth clients from a single webinar.

This story is the perfect illustration of a new paradigm. It's about seeing a niche where others see a crisis and leading with value when others lead with a sales pitch. It was a masterstroke. And yet, the very forces that enabled his success. the ability to reach a niche online have now evolved into a new and even more complex challenge for advisors today. The world has moved on, and now advisors are fighting a war for growth on two new fronts.

Part 2: The Two Fronts of a Broken War

Advisors today are fighting a war for growth on two fronts, both of which are deeply broken. On one side is the battle to be the AI's chosen answer. On the other is a costly, hand-to-hand combat in the digital maze of lead-generation sites and directories.

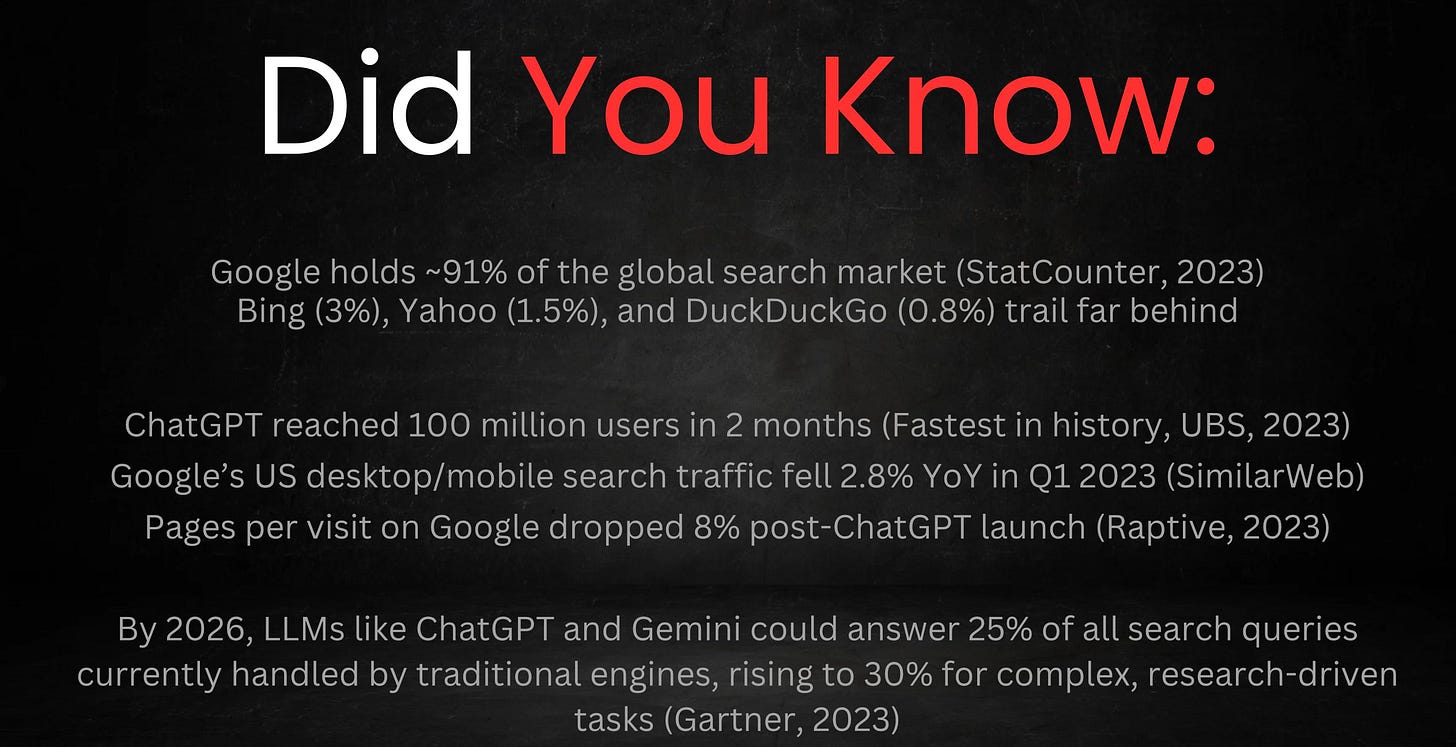

Front 1: The New Battle for AI Authority

Consider the first front: "Answer Engine Optimization" (AEO). The goal here is to convince an intelligence you are an authority worth citing when a user asks, "I'm a partner at a law firm approaching retirement, who is the best financial planner for my situation?" This requires deep, demonstrable expertise, content structured for machine learning, and original research that sets you apart. It's a complex, long-term strategy of building true authority.

Front 2: The Great Digital Sprawl

While fighting the future war of AEO, advisors are simultaneously stuck in the messy, expensive present: the chaotic ecosystem of online directories. This is the great digital sprawl—a seemingly endless collection of websites, all promising to connect you with your next great client, each with a different business model designed to extract a toll.

This fragmented model is a tax on growth. Consider the plight of a modern advisory firm:

The Pay-per-Lead Toll: They are forced to buy expensive, often low-quality, leads from high-traffic consumer sites like SmartAsset, NerdWallet, or WiserAdvisor, competing with dozens of other advisors for the same prospect. Or they use services like Bark.com or AdviceChaser, where they must pay to even respond to a client request.

The Subscription Maze: They maintain costly premium profiles on a dizzying array of platforms. A subscription to GuideVine for its video-centric approach, a paid listing on Wealthtender for its review focus, and a membership with the National Ethics Association to signal trustworthiness.

The Niche Necessity: To reach specific demographics, they must pay for placement in specialized directories: the White Coat Investor to attract doctors, the XY Planning Network to serve Gen X/Y clients, or Senior Finance Advisor to target retirees. Each niche has its own walled garden and its own fee.

The Membership Obligation: Their professional affiliations, like the FPA PlannerSearch or NAPFA's directory, require dues but offer another profile to maintain.

The Free-for-All: All of this is on top of managing their "free" but critical public-facing reputations on Google Business Profile, BrokerCheck, Investor.com, and even Yelp.

This is the illusion of choice. It’s a costly, time-consuming, and inefficient system that creates confusion for both clients and advisors. Which platform is legitimate? Which lead is worth the price? How do you manage your brand across two dozen different sites, each with its own login and rules? This digital fragmentation is the very problem that the next generation of technology is destined to solve.

Part 3: The Data Arms Race: A California Case Study

Given this chaotic landscape, the only rational response is to build a system that allows you to bypass it entirely. This isn't a hypothetical future; it's a project currently being built, and it reveals the blueprint for the next evolution of growth.

We have been discussing with a CPA in California on this very problem. His goal was to get in with the right RIAs and SEC-registered firms not just any firm, but specifically those whose clients were in the tech and startup world. He specializes in the complex compensation packages common in that space, and he knew that financial planners serving those clients constantly need a CPA referral they can trust.

The old method would be a disaster. Cold calling a list of RIAs in Silicon Valley? Sending a thousand generic "Let's partner up" emails on LinkedIn? He would be ignored.

Instead, we are architecting a new kind of "growth engine."

Step 1: The Proprietary Foundation.

The process begins not by licensing data, but by building a proprietary repository from the ground up. The foundational layer is created by pulling data directly from primary public sources like the SEC's EDGAR system and FINRA's regulatory filings. This provides a clean, verified, and comprehensive base of every registered firm and advisor in California, including their Form ADV metrics, AUM, client count, and registration history. This first step alone creates a powerful tool for screening the market.

Step 2: The Unstructured Intelligence Layer.

This is where the real magic happens. With the verified foundation in place, the engine then builds a second layer, systematically scraping the public internet for every indexed mention of the target firms and their key principals. It ingests everything: every podcast feature, every article they've published, every conference they've spoken at, every local news mention, every post they've 'liked' on social media.

Step 3: Creating the "Data Plot."

The system synthesizes this mountain of unstructured data into a coherent "data plot" for each firm. It’s a living dossier that reveals needs and opportunities.

The engine flags that an RIA's founder was recently on a podcast discussing the challenges of QSBS, but she didn't mention the latest legislative changes.

It notes that the firm's blog has three articles on stock option planning but hasn't published anything on a major tax-loss harvesting opportunity that just opened up.

It sees from an advisor's LinkedIn profile that he just connected with three executives from a local company that is rumored to be nearing an IPO.

The CPA now knows more about the firm's immediate needs than they may even know themselves.

Step 4: The Hyper-Relevant Outreach.

The CPA doesn't send a cold email. He sends a surgical strike. The message isn't, "Hi, I'm a CPA, want to partner?" It's:

"Hi [RIA Founder Name], I heard your fantastic interview on the [Podcast Name] podcast about serving founders. Your point on QSBS was spot on. I've been working with my tech clients on a new strategy related to the AMT complexities that arise post-sale, which I didn't hear mentioned. Do you have 15 minutes next week to discuss it? I think it could be valuable for your clients."

The chance of this email getting a positive reply is exponentially higher than a generic cold call. This is no longer marketing; it's applied intelligence. This is where the industry is heading.

Part 4: The Inevitable Future: Intelligence and Trust

The project being built with the California professional isn't just a clever hack; it is a signal of the inevitable future of growth in the financial services industry. The era of winning through brute force bigger ad budgets, more cold calls, more directory listings is ending. It is being replaced by an era of winning through intelligence.

The chaotic and fragmented systems that define the present are unsustainable. They drain resources, create confusion, and fail to serve clients or advisors effectively. The future belongs to those who can rise above the noise. This will be accomplished on two fronts:

Public Authority: Building deep, specialized knowledge and structuring it in a way that AI "answer engines" recognize as authoritative, making you the expert of choice.

Private Intelligence: Developing or accessing a sophisticated growth engine that can identify needs and opportunities with a precision that was unimaginable just a few years ago.

This shift will be profound. The competitive advantage will move away from the firms with the largest marketing departments and toward those with the best data and the most relevant message. It will reward true specialists over generalists.

But this new power brings with it a new responsibility. As we develop the capacity to "know more about a firm's needs than they may even know themselves," the imperative for ethical application becomes paramount. The goal of such a powerful tool cannot simply be to make a sale; it must be to deliver immense, timely, and undeniable value.

The firms that will truly thrive in 2030 and beyond will be the ones that master this duality. They will be technologically advanced, data-driven organizations that are also, fundamentally, built on a foundation of unimpeachable trust and transparency. They will use the power of intelligence not just to find clients, but to serve them in ways we are only now beginning to imagine.

To access Capithos Financial Intelligence subscribe or contact@theriareport.com Coverage spans across 46K+ US SEC/RIA firms, 400,000+ Financial Professionals, 75+ Job boards and networking sites with finance, banking, and funds focus. We also provide custom datasets based on specs of investment institutions, firms, and financial professionals.