RIA & SEC Market Pulse: H1 2025 Data, Key Trends, and H2 Projections for Firm Owners

Navigating the Next Wave: Essential Insights from Capithos & Market Signals for Time-Pressed Leaders

The RIA Report: Fifth Submission – Half-Year Review: M/m Change in Firms Across the US

For leaders in Wealth Management and Investment Firms, time is paramount. This H1 2025 market pulse delivers critical data and trends shaping the RIA and SEC landscape. Drawing on public records from IARD and SEC BrokerCheck, plus deep intelligence from our proprietary Capithos data repository (covering 46,000+ firms, their AUM, tech, and client focus), we examine net firm changes from January to May 2025. This concise review offers strategic foresight into M&A, economic pressures, and hiring, essential for your C-suite and compliance teams.

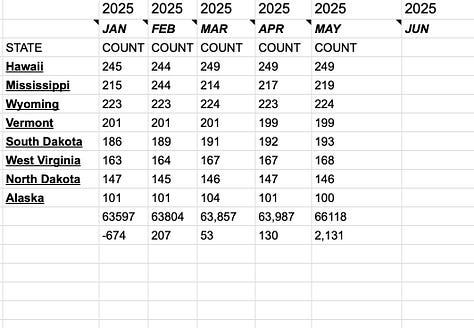

The US registered investment advisor (RIA) and Securities and Exchange Commission (SEC) firm count rose by a net 260. This figure, however, only scratches the surface.

The National Count: A Story of Measured Expansion

A net gain of 260 firms nationwide (Jan-May 2025) indicates steady, not explosive, industry evolution. This measured growth in a mature market underscores deeper currents of change.

Net figures alone can mask the true dynamism. The real insights lie in the gross changes and underlying firm characteristics.

Beyond Net Changes: Unpacking the "Why" with Capithos & Market Intelligence

The +260 net change doesn't reveal the full picture. Our Capithos data provides crucial context on the firms entering and exiting the market.

Strong M&A activity characterized early 2025. A record Q1 was driven by needs for scale, succession planning, and significant private equity investment. May 2025 saw continued consolidation. Carson Group’s acquisition of SRQ Wealth and Simon Quick Advisors’ purchase of Proquility Private Wealth Partners are recent examples. Capithos often shows acquired firms had specific AUM levels or niche clienteles attractive to larger entities.

Economic headwinds, including a Q1 US slowdown and inflation concerns, also pressure firms. Rising compliance costs, evidenced by SEC enforcement priorities, can accelerate decisions to sell or merge.

State-Level Dynamics: A Decoded Patchwork of Progress

National averages obscure diverse regional stories. Capithos insights into firm profiles clarify these state-level trends:

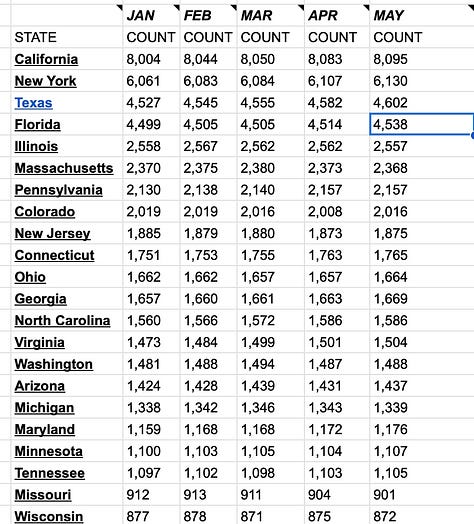

Growth Hotspots: Several states showed notable net firm growth. California (+91 firms) saw many new RIAs leveraging advanced tech stacks to serve specialized clients, a trend visible in Capithos. Texas (+75), New York (+69), and Florida (+39) also saw strong expansion. Pennsylvania (+27), Utah (+25), and Arizona (+13) followed, often linked to economic vitality and demographic shifts.

Consolidation Corners: Minor net declines in states like Oregon (-5 firms), Colorado (-3), Massachusetts (-2), and Illinois (-1) often reflect M&A. Local firms are frequently acquired by larger, out-of-state players—a pattern Capithos helps track. Retirements and operational cost pressures also play a role.

The "Quiet Revolution" Continues: Data-Driven Perspectives

Early 2025 trends affirm themes from The Quiet Revolution. Advisors seek independence. They leverage technology (a key Capithos data point). They adapt to rising client demands for holistic advice.

The net growth includes many new, independent RIAs. Technology lowers entry barriers, enabling smaller firms. M&A, confirmed by Q1 and May 2025 deal flow, is a powerful reshaping force. Capithos helps identify profiles of firms involved in this consolidation.

(read the article here - (https://tinyurl.com/3h9y4p2p)

The Modern Advisor: Navigating Complexity with Data and Tech

Advisors face sophisticated client demands and persistent fee pressures. Firms that thrive adapt. They embrace technology for efficiency, a trend clear in Capithos’s tech stack data. They also deliver demonstrable value through specialization or personalized service, insights also derivable from detailed firmographic data.

Industry Pulse: H2 2025 Outlook and Hiring Headwinds

The H2 2025 hiring outlook is challenging. Firms face talent scarcity for experienced advisors and tech-savvy staff, increasing recruitment costs. This "hiring tariff" makes strategic talent acquisition and retention critical for growth in a competitive landscape.

This Friday’s NFP Report will shed light, and in our view set the start of a new shift towards hiring and roles within wealth management and finance. Stay tuned!

-END